The 2024 Atlantic hurricane season is predicted to be above normal by forecasters. NOAA anticipates 17-25 named storms, 8-13 hurricanes, and 4-7 major hurricanes. This is significantly higher than the season average. Texas has already encountered its first named storm. Scientists believe climate change is making hurricanes more dangerous, posing significant risk not only to human life and ecosystems, but also to the economy, housing, and infrastructure. An important question that stems from this is how do hurricanes impact home prices?

To analyze the impact of hurricanes on home prices, we identified the top four hurricanes from NOAA’s 2024 list of costliest hurricanes (cost values are based on the 2024 CPI adjusted cost) that made landfall near major population centers. Given the broad geographical reach of Hurricane Sandy, affecting multiple regions and metropolitan areas along the East Coast, we chose not to include it in our analysis.

| Storm | Year | Category | Damages (2024 CPI adjusted) | Affected Area |

|---|---|---|---|---|

| Katrina | Aug-05 | 3 | $200.0B | New Orleans, LA |

| Harvey | Aug-17 | 4 | $158.8B | Houston, TX |

| Ian | Sep-22 | 4 | $118.5B | Fort Myers, FL |

| Hugo | Sep-89 | 4 | $22.6B | Charleston, SC |

Our analysis of home price appreciation in hurricane-impacted cities yielded interesting results. In three out of four cases, property values increased more rapidly in the quarter following the storm compared to the preceding quarter (y-o-y appreciation).

For instance, New Orleans experienced an 8% price appreciation before Hurricane Katrina, which surged to 13.7% in the quarter after the storm. Conversely, Fort Myers saw a dramatic slowdown, from 35% appreciation before Hurricane Ian to 14% afterward. This decline aligns with the broader cooling of the Florida housing market.

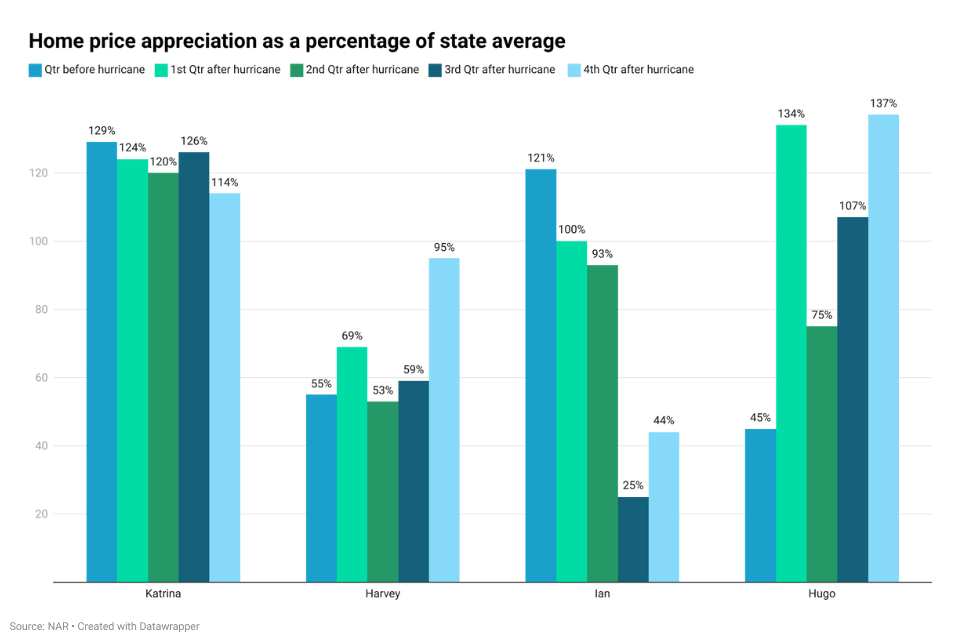

Several non-hurricane-related factors can influence home prices before and after a storm. For instance, a city’s overall housing market conditions, such as a seller’s market or a post-pandemic cooldown as seen in Fort Myers, can impact prices. To isolate the hurricane’s effect, we normalized the appreciation data for each city by comparing it to the state’s average appreciation during the same periods.

Harvey and Hugo exhibited similar post-hurricane trends. While Charleston experienced accelerated home price appreciation relative to South Carolina in the quarter following the storm, Houston’s appreciation jumped from 55% to 69% of the Texas average. In contrast, Katrina and Ian followed a different pattern. Home price appreciation in New Orleans and Fort Myers as a percentage of the Louisiana and Florida state averages was lower in the four quarters post-storm compared to the pre-storm quarter.

Immediately following a hurricane, housing markets typically experience upward pressure on prices due to classic supply and demand dynamics. The surge in demand stems from displaced residents seeking temporary housing while rebuilding their homes. Simultaneously, the storm often damages a portion of the housing inventory, reducing supply. This combination of increased demand and decreased supply naturally drives prices upward. However, this was not observed in the Fort Myers housing market. While demand and supply imbalances usually drive prices up, the dramatic surge in insurance costs has deterred potential buyers in the flood impacted Fort Myers region. Many homeowners have even lost coverage entirely, further exacerbating homeownership challenges.

As climate change supercharges hurricanes and intense floods become more frequent and severe, insurance companies are facing increased payouts. To maintain profitability, they are passing these costs on to policyholders in the form of higher premiums or even refusing to offer policies altogether. Higher premiums and reduced coverage is driving away many potential home buyers from high risk areas. Recent events like Hurricane Beryl highlight the need for tools such as Veros Disaster VisionSM that can quickly assess property-level damage from hurricanes, fires, floods, and earthquakes. Such insights can help lenders and servicers prioritize resources and make informed decisions to support borrowers in the aftermath of disasters.