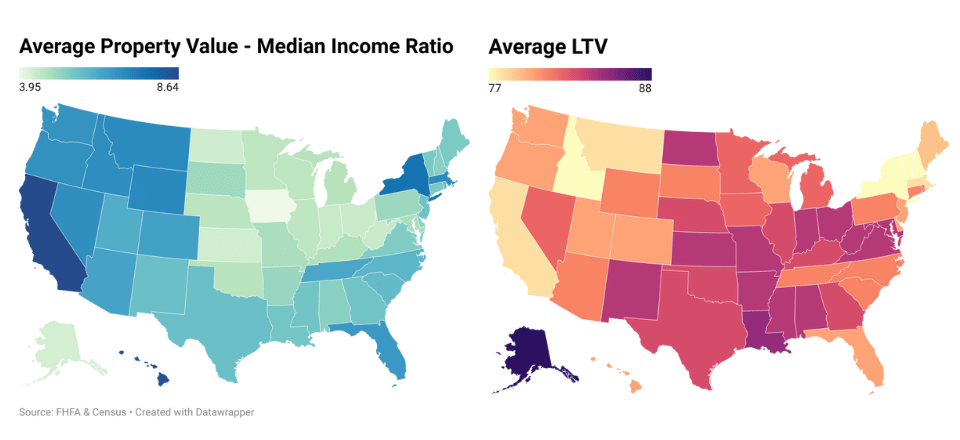

California has one of the highest property prices in the nation. The golden state also has the highest property value (average property values for all the mortgage originations in 2022) to median income ratio. For years, the narrative has been that sky-high housing costs force Californians to stretch thin, requiring massive loans to secure even a median-priced home. But the data paints a different picture. California’s LTV ratio, which measures the loan amount relative to the property value, ranks among the lowest in the country, following states like New York and Idaho.

So, what’s driving this disconnect? Here are some possible explanations:

Existing homeowners in California hold the key to part of the puzzle. Many Californians likely bought their homes years ago when prices were lower. This means they have accumulated significant equity – the difference between their home’s current value and their remaining mortgage balance. When these Californians look to upgrade or move within the state, they can leverage this equity to make substantial down payments on their new properties. This reduces their need for large mortgages, bringing down the overall LTV ratio.

California’s high-end market might be another contributing factor. Wealthy Californians selling their expensive properties may be using the proceeds to buy even more expensive homes within the state. While these new homes come with higher price tags, the significant down payment from the previous sale keeps the loan amount, and consequently the LTV ratio, as a percentage of the purchase price, relatively low.

While existing residents benefit from built-up equity, newcomers face a different reality. They enter a competitive market with limited equity and may need larger loans to compete. This could potentially push the average LTV ratio higher for this segment. However, this trend might be counterbalanced by the strong down payment practices of established Californians, as discussed earlier.

Additionally, California boasts the highest percentage of homebuyers in the 35-54 age group (around 52%) compared to other states. This suggests a population of buyers who have likely been in the workforce longer, potentially allowing them to save for a larger down payment. This aligns with the theory that established Californians are leveraging equity and strong down payments, keeping the overall LTV ratio lower despite the high property values.

While these explanations shed light on the California housing market, further investigation is needed to fully understand the dynamics at play. Are these trends concentrated in specific areas of the state? Is there a significant difference in LTV ratios between first-time homebuyers and repeat buyers? Delving deeper into these questions can provide valuable insights into the true affordability picture for Californians of all ages and financial backgrounds, ultimately painting a more complete picture of the Golden State’s unique real estate landscape.