The Federal Housing Finance Agency (FHFA) House Price Index recently reported that U.S. house prices increased by 5.7 percent between the second quarter of 2023 and the second quarter of 2024. The national housing market has registered an annual appreciation each quarter since early 2012.

Strong Price Growth Across the Country

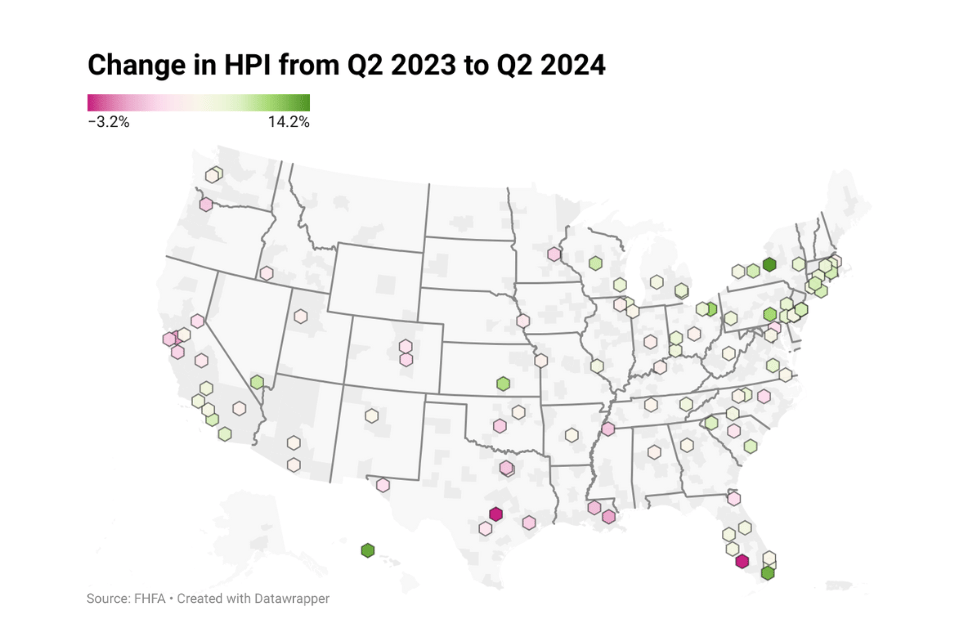

All 50 states and the District of Columbia saw increases in house prices from Q2 2023 to Q2 2024. Vermont led the way with a 13.4 percent annual appreciation, followed by West Virginia (12.3 percent), Rhode Island (10.1 percent), Delaware (10.0 percent), and New Jersey (9.9 percent).

Among the top 100 largest metropolitan areas, 96 experienced rising house prices over the past four quarters. Syracuse, NY, took the top spot with a 14.2 percent annual price increase, followed by Urban Honolulu, HI (13.4%), Miami-Miami Beach-Kendall, FL (13%), Akron, OH (11.4%), and Newark, NJ-PA (11.2%). Twelve of the 15 metros with the highest price increases were in the Northeast and Midwest.

Metros with the largest price declines at 3.2% were Austin-Round Rock-Georgetown, TX, and Cape Coral-Fort Myers, FL. The other metros with price declines were Oakland-Berkeley-Livermore, CA, and New Orleans-Metairie, LA.

Defying Mortgage Rate Increases

Despite the 30-year fixed mortgage rate remaining elevated between 6.6 percent and 7.79 percent during the second quarter of 2023 to the second quarter of 2024, home prices continued to climb on a national level. A key factor driving this trend is the ongoing imbalance between supply and demand in the housing market. While the number of homes available for sale has been gradually increasing, it still falls significantly short of what would be considered a balanced supply.

Factors Driving Demand

Several factors have contributed to the sustained demand for housing. A strong labor market, with rising wages and an unemployment rate below 4 percent during the second quarter of 2023 to the second quarter of 2024, has provided a solid foundation for homebuyers. Additionally, the formation of new households by GenZ and millennials has further fueled demand.

In conclusion, the U.S. housing market continues to exhibit resilience, with home prices steadily rising despite elevated mortgage rates. The ongoing imbalance between supply and demand, coupled with strong economic indicators, suggests that upward pressure on prices may persist in the near future.