The current housing market is dominated by historically low supply and home sales. The housing market boomed during the pandemic years and now seems to be in a frozen state. But what is different in the US economy that is making it so? Is it the employment landscape, inflation, or could it be the simultaneous rapid surge in mortgage rates and home prices over the past three years in combination with the demographic trends?

Before the pandemic, the average unemployment rate stood at 4.4% in 2017, 3.9% in 2018, and 3.7% in 2019. Remarkably, this rate has remained relatively stable, averaging 3.6% throughout 2022 and 2023, indicating a sustained robust job market.

On the flip side, inflation, which averaged 2.4% in 2018 and stayed under 2% in 2019 and 2020, saw a significant uptick to 4.7% in 2021, 8% in 2022, and 4.1% in 2023. While this placed a strain on households’ balance sheets, the impact was partially offset by the robust labor market and accompanying wage growth. Wages, which grew at an annual rate of around 3% during 2017-2019, surged to 4%-5% in the post-pandemic years of 2021-2023. However, these factors alone weren’t sufficient to bring about the current state of the housing market. It’s the actions taken by the Fed to curb inflation and their impact on mortgage rates and the continued strong demand for housing that have contributed to the housing market’s current state.

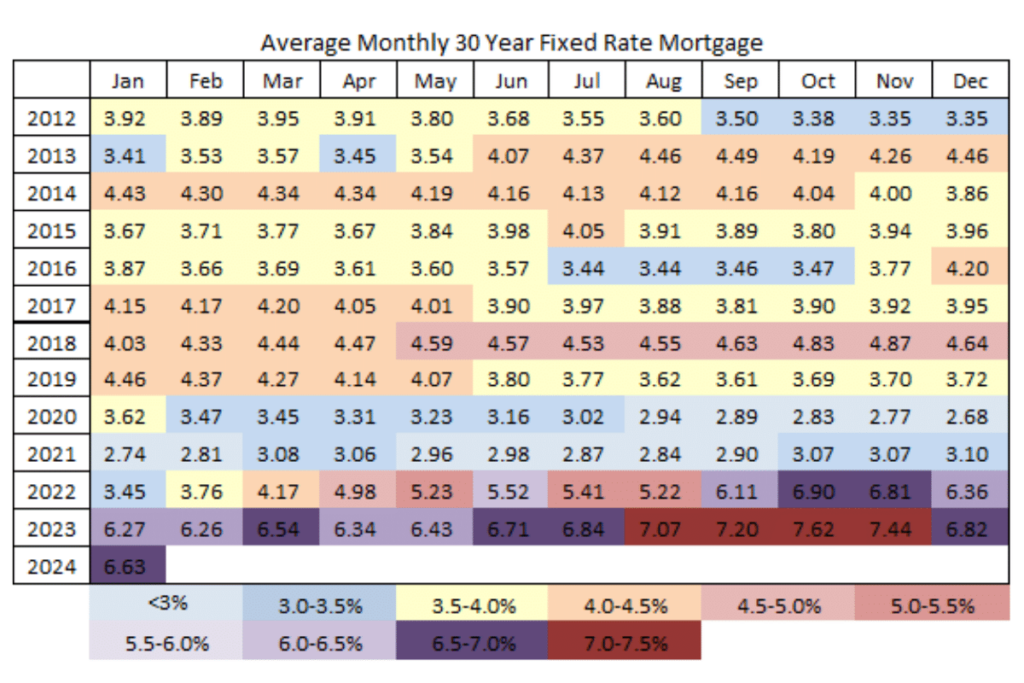

From 2017 to 2019, the average monthly mortgage rates fluctuated between 3.61% and 4.87%, as depicted by the yellow, orange, and light red shades. In 2021, the color palette shifted entirely to blue, indicating a very narrow range of low rates from 2.74% to 3.10%. During this period, households secured low-rate mortgage contracts through purchases or refinancing. However, the scenario changed dramatically in 2022, transitioning from light blue to yellow, orange, light and darker red, and finally light and darker purples, as rates skyrocketed from 3.45% to 6.9% within a year. When mortgage rates entered the purple range, housing supply sharply decreased as homeowners hesitated to trade their sub-4% mortgages for higher-rate contracts.

Moreover, in tandem with the rapid increase in mortgage rates, robust housing demand endures due to shifting demographics. Millennials and Gen Z are establishing households at a brisk pace, contributing to the demand, while affluent baby boomers are hesitant to part with their homes, propelled by stock market gains and savings. As new households form and housing construction struggles to keep up, the shortage in supply remains persistent. The current gap between demand and supply amounts to several million homes and shows no signs of diminishing any time soon. For there to be a substantial increase in supply, mortgage rates would need to dip significantly, but when that happens, demand will also rise accordingly, fueling prices further.