Many in the housing industry anticipated that the Fed would implement multiple rate cuts in 2024, leading to lower mortgage rates, and therefore improved affordability, and a more balanced housing market.

The Fed has implemented a single rate cut so far in 2024, reducing the Fed Funds rate by 50 basis points in September. Mortgage rates declined to 6.08% by the end of September but have since risen to 6.72% (October 31, 2024). While the Fed’s rate cut in September initially provided some relief, subsequent economic data, particularly the robust labor market, has led to expectations of continued higher rates. As a result, the 10-year Treasury yield, which closely correlates with mortgage rates, has trended upward. Although mortgage rates have declined from their 2023 peak of 7.79% in October and the 2024 high of 7.22% in May, they remain elevated and have not been sufficient to reignite buyer activity. Many potential homebuyers are adopting a wait-and-see approach, hoping that additional Fed rate cuts later this year will further reduce mortgage rates.

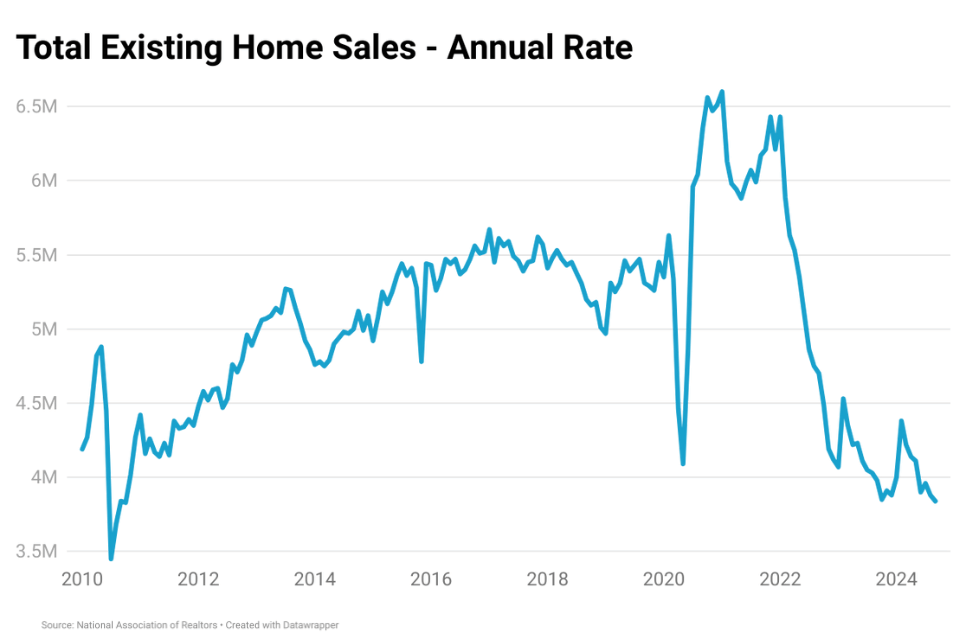

Lower demand is evident in the decline of existing home sales, which fell to an annual rate of 3.84 million in September 2024, from 3.98 million recorded a year ago. This marks the lowest level since 2010, following the housing market crash. Historically, the annual rate of existing home sales has consistently exceeded 4.5 million since 2012, prior to the pandemic. However, the current decline is not a result of a market crash, as house prices have continued to rise. While affordability challenges persist in the current housing market, many buyers continue to purchase homes, fueled by a strong job market

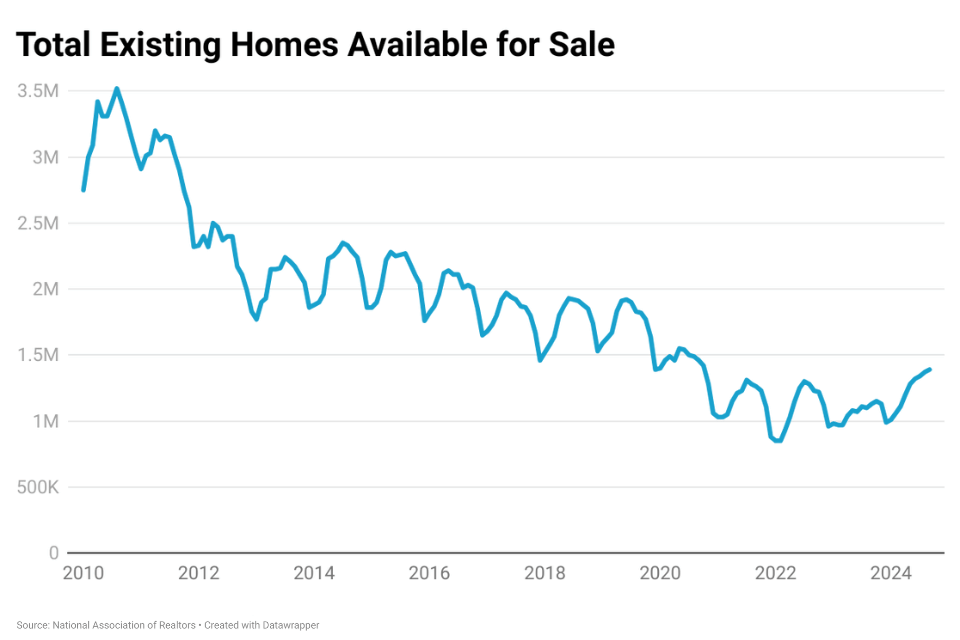

While the supply of existing homes has been gradually increasing, home prices have continued to rise, defying the traditional relationship between supply and demand. This is because the number of homes for sale is lower than the levels seen before the pandemic. In September 2024, 1.39 million homes were available for sale, compared to 1.82 million in September 2019. The rapid increase in mortgage rates in 2022 has led to a lock-in effect, where homeowners are hesitant to sell their homes due to the risk of acquiring new mortgages at higher interest rates. As a result, only those who are compelled to move due to life changes are actively selling their homes, while many others are choosing to stay put.

While a slight decline in mortgage rates may occur in the near future, a substantial drop is unlikely. Those anticipating rates to decline to below 6% will have to wait a while. Absent a significant rate reduction, the housing market is expected to remain subdued, with limited buyer activity and price appreciation. Additionally, the housing market continues to exhibit regional disparities. While some areas are experiencing price growth, others have slowed down or even seen declines.